fit on paycheck stub

They are all different taxes withheld. Some are income tax withholding.

I just received my first paycheck at a new job I started two weeks ago I have a 65000year salary - the base earnings for 40 hours is 1250.

. Information is filled in and the stub is printed and attached to the paycheck. TDI probably is some sort of state-level disability insurance payment eg. The rate is not the same for every taxpayer.

Please refer to our FAQs page for any queries related to our pay stubs including payment return policy and cancellation. In the United States federal income tax is determined by the Internal Revenue Service. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

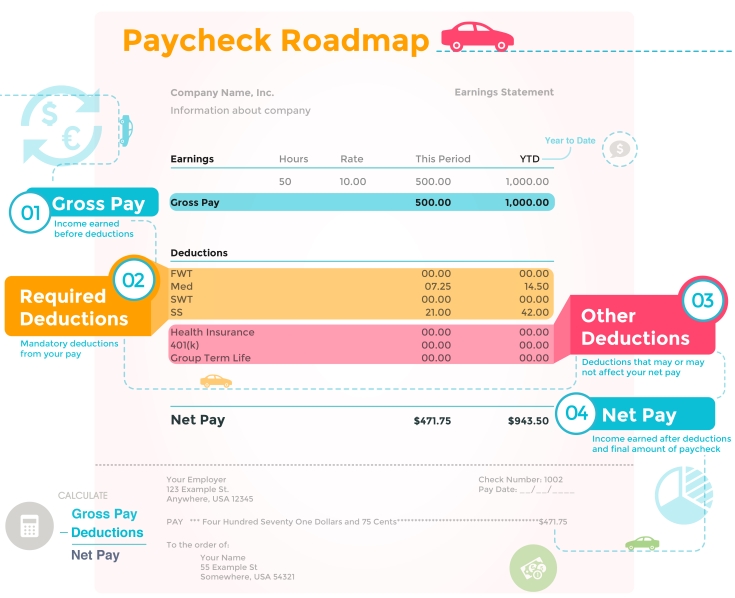

This tax includes two separate taxes for employees. FIT Fed Income Tax SIT State Income Tax. One of the largest deductions that you may see on your paycheck is a FIT tax deduction.

These items go on your income tax return as payments against your income tax liability FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. What is the website for Outback employees pay check stub. You can complete the payment with your preferred payment methodPayPal debit card or credit card.

On a pay stub this tax is abbreviated SIT which stands for state income tax. Based on Publication 15-T 2021 Federal Income Tax Withholding Methods you can use either the Wage Bracket Method or the Percentage Method to calculate FIT. Other groups such as.

FIT on a pay stub stands for federal income tax. Also inform yourself about any applicable SIT withholdings. FICA means Federal Insurance Contribution Act.

The taxable wages are likely less than his actual salary because of pre-tax deductions health insurance retirement investments etc which reduce his taxable income. Federal Income Tax FIT is calculated using the information from an employees completed W-4 their taxable wages and their pay frequency. FIT is applied to taxpayers for all of their taxable income during the year.

They go toward costs needed to run the federal government. Double-Check Your Pay Stub. What Are FIT Tax Implications Its important that you understand the FIT Tax implications on your paystub.

FIT stands for federal income tax. FIT deductions are typically one of the largest deductions on an earnings statement. Its the wages that are taxable for FIT.

This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. Here is a list of paycheck stub abbreviations that relate to your earnings. The Employees social security number.

FIT means federal income taxes. For more pay stubs youll need to pay a small fee of 499stub. The best way to do that is to review your pay stub and address any concerns.

FIT on a pay stub stands for federal income tax. German tax and payroll laws can be a hassle let Paychex handle that for you. Some entities such as corporations and trusts are able to modify their rate through deductions and credits.

Medicare covers medical related costs when you are old and gray. I just received my first paycheck at a. We can help with your payroll.

Some payroll companies use their own set of these abbreviations while some dont. Essentially FITW or FIT Withheld means that some of your salary wages or earnings have been withheld to pay for the Federal Income Tax. This is the income tax you pay to your local government.

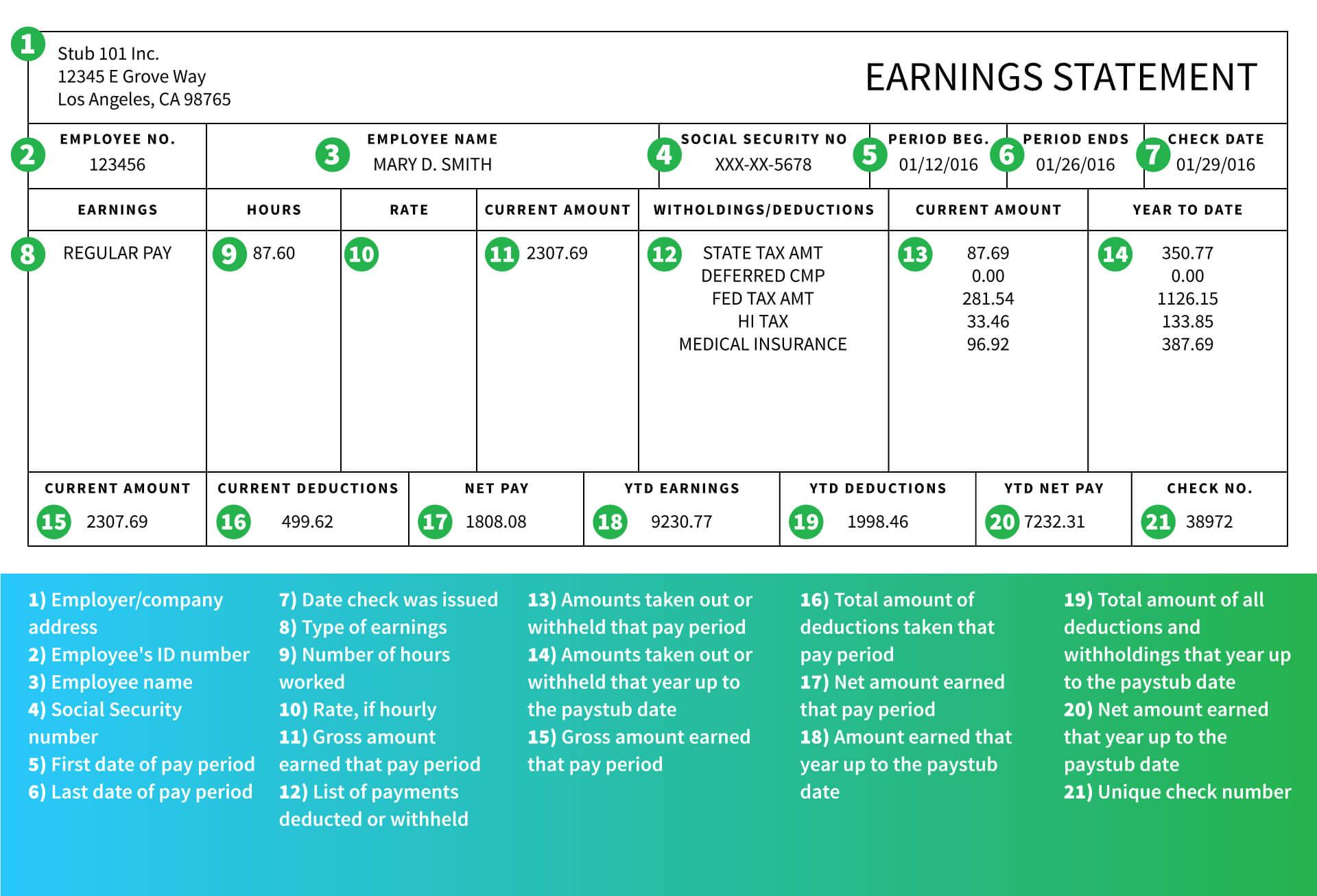

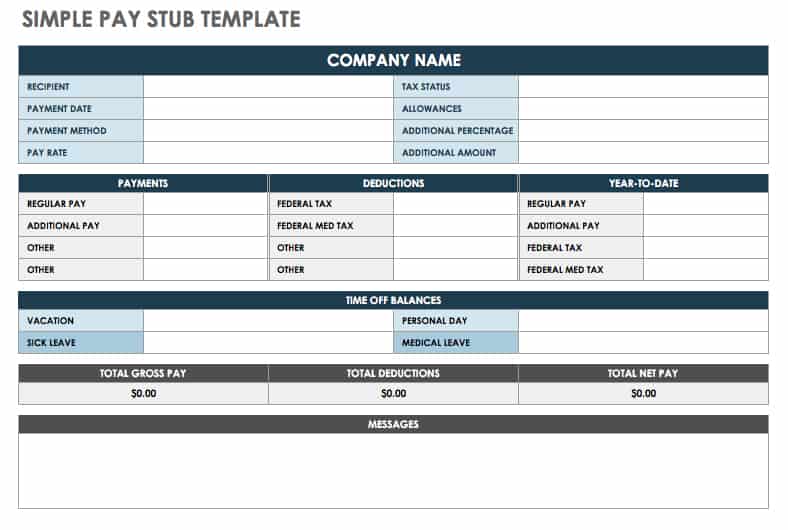

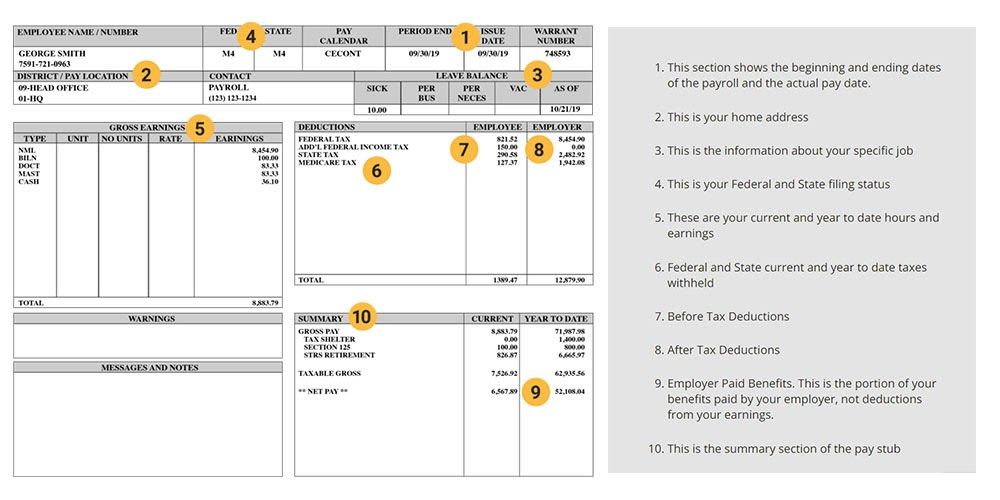

A simple table is inserted in the document to create spaces for employer and employee information hours worked amounts paid and deductions. Document stub A document stub is a word document stub prepared through a word processing software such as Microsoft Word. It covers two types of costs when you get to a retirement age.

On your pay stub youll see some common payroll abbreviations and some that arent so common. FIT is applied to taxpayers for all of their taxable income during the year. How do you calculate fit on a paycheck.

If a paycheck shows 000 or no income tax withheld it may be caused by any of the following. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Add Pay Additional pay BRVMT Bereavement pay Cmp Pyot Compensatory time payout CNT Pay Contract pay or your salary Hol Holiday pay Jury Jury duty pay Misc Miscellaneous pay Move Rem Move reimbursement OnCall On-call pay PTO Personalpaid time off.

Click to see full answer thereof what is fit on my paystub. Create Modern Pay Stub Generator for Your Financial Needs. Pay Stub Abbreviations are the abbreviations that you come across on any pay stub.

Payroll companies abbreviate the information that is printed on your pay stub to reduce it and make it easier for them to fit a lot of information on a single sheet of paper. Know what your FIT tax rate is and memorize the FICA percentage 765. Other groups such as charitable organizations can apply for tax-exempt status.

This makes sense thank you. The FIT gross is what I would expect to see in Box 1 of the W-2. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

In the united states federal income tax is determined by the internal revenue service. 1 medicare and 2 social security. An employees pay stub is simply a part of the paycheck.

Cmp Pyot Compensatory time payout. For example for 2021 if youre single and making between 40126 and 85525 then you are. I expected - for a two week pay period - to get around 1800 but the deductions included 79125 for CT SIT 38462 for FIT 3625 for MCEE and 105 for TSSE - the last two deductions I have no clue.

Ad Are you a business owner or an employer in Germany. At the end of the day you want to know how to read a pay stub to make sure your paycheck is accurate. This is the amount of money earned during the pay period.

121 understanding your pay stub. FIT Fed Income Tax SIT State Income Tax.

The Ultimate Check Stub Template Monday Com Blog

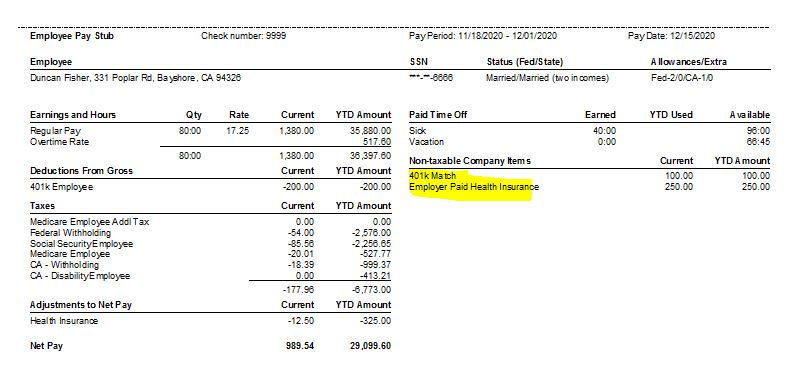

Employer Paid Healthcare On Paystub

25 Great Pay Stub Paycheck Stub Templates Template Printable Payroll Template Business Checks

A Guide On How To Read Your Pay Stub Accupay Systems

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed O Word Template Payroll Template Templates Printable Free

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Read A Pay Stub Gobankingrates

With Free Pay Stub Generator You Can Make Free Paycheck Stubs And Can Get A Chance To Make 1st Stub Free Give It Payroll Template Printable Checks Templates

The Ultimate Check Stub Template Monday Com Blog

Free Pay Stub Templates Smartsheet

How To Read A Pay Stub Gobankingrates

Understanding Your Paycheck Harmon Street Advisors

Understanding Your Paycheck Credit Com

Employee Pay Stub Template Excel Word Apple Numbers Apple Pages Pdf Template Net Templates Words Word Doc

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Does Pay Stub Pay Check Stub Salary Slip Or Payslip Mean