tempe arizona sales tax calculator

Apache Junction is located within Pinal County Arizona. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tempe AZ.

How To Register For A Sales Tax Permit In Arizona Taxjar

For more information on vehicle use tax andor how to use the calculator click on the links below.

. Sales Tax Calculator Sales Tax Table. Gila County 66 percent. Object Moved This document may be found here.

The Arizona sales tax rate is currently. The current total local sales tax rate in Tempe Junction AZ is 6300. The average cumulative sales tax rate in Apache Junction Arizona is 96.

Each of these match the federal standard deduction. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Did South Dakota v.

The combined rate used in this calculator 81 is the result of the Arizona state rate 56 the 85281s county rate 07 the Tempe tax rate 18. Real property tax on median. The sales tax rate does not vary based on.

The County sales tax rate is. If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona. Tempe collects a 25 local sales tax the maximum local sales tax allowed under Arizona law.

The statewide rate is 560. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223.

Youll have to pay state and local sales taxes on purchases made in Arizona. Method to calculate Tempe Junction sales tax in 2021. Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25.

This is the total of state county and city sales tax rates. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Maximum Local Sales Tax. SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here. Method to calculate Tempe Cascade sales tax in 2021.

The December 2020 total local sales tax rate was also 6300. As of 2020 the current county sales tax rates range from 025 to 2. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state.

The Tempe Arizona sales tax rate of 81 applies to the following seven zip codes. Arizona has a 56 statewide sales tax rate but also has 80 local tax jurisdictions including. Then use this number in the multiplication process.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. The Tempe sales tax rate is. When combined with the state rate each county holds the following total sales tax.

Groceries are exempt from the Tempe and Arizona state sales taxes. There are a total of 101 local tax jurisdictions across the state collecting an average local tax of 2146. The minimum combined 2022 sales tax rate for Tempe Arizona is.

Tempe has a lower sales tax than 692 of Arizonas other cities and counties. Arizona State Sales Tax. Divide tax percentage by 100 to get tax rate as a decimal.

Tempe AZ 85280 salestaxtempegov. The Tempe Sales Tax is collected by the merchant on all qualifying sales made within Tempe. Average Local State Sales Tax.

Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. Tempe Sales Tax Rates for 2022. US Sales Tax Rates AZ Rates Sales Tax Calculator Sales Tax Table.

Just 19month for preparation and 25 per optional auto filing. Cochise County 61 percent. Start your free trial.

Pinal County 72 percent. If you choose not to itemize on your Arizona tax return you can claim the Arizona standard deduction which is 12550 for single filers and 25100 for joint filers. City Hall 31 E.

Multiply the price of your item or service by the tax rate. Taxes in Tempe Arizona are 304 more expensive than Casper Wyoming. Within Apache Junction there are around 4 zip codes with the most populous zip code being 85120.

Maricopa County 63 percent. Wayfair Inc affect Arizona. Modify Section 16-460a entitled Retail Sales.

How to Calculate Sales Tax. You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code. Just enter the five-digit zip code of the location in which.

You can find more tax rates and allowances for Tempe and Arizona in the 2022 Arizona Tax Tables. What city in Arizona has the highest tax. 85280 85281 85282.

The average sales tax rate in Arizona is 7695. The current total local sales tax rate in Tempe AZ is 8100. Apply or Renew on the Accela Citizen AccessACA Portal.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. A The tax rate shall be at the amount equal to one and eight-tenths percent 180 of the gross income from the business activity upon every person engaging or continuing in the business of selling tangible personal property at retail. Sales tax in Tempe Arizona is currently 81.

City and County Additions. This includes the rates on the state county city and special levels. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112.

What is the sales tax rate in Tempe Arizona. Maximum Possible Sales Tax. Cost of Living Indexes.

The average sales tax rate in Arizona is 7695. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. Sales Tax State Local Sales Tax on Food.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. AZ is in Maricopa County. Our Premium Cost of Living Calculator includes State and Local Income Taxes.

However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License. The December 2020 total local sales tax rate was also 8100. Apache County 61 percent.

Find list price and tax percentage. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Arizona Income Tax Calculator Smartasset

Ramada By Wyndham Tempe At Arizona Mills Mall Tempe Az 1701 West Baseline Rd 85283

Carvana S Chaotic Zoom Firing Caps Company S Struggles Amid Market Downturn

Arizona Income Tax Calculator Smartasset

Arizona Sales Tax Rates By City

Icalculator List Of Free Online Calculators

Wellness Hotel In Tempe The Westin Tempe

Advanced Manufacturing Ecosystem In Greater Phoenix Gpec

Sales And Use Taxes Chandler Lbs Tax

Small Business Accounting And Bookkeeping Services In Phoenix Tempe Chandler Gilbert Mesa Arizona Threelyn Accounting Services

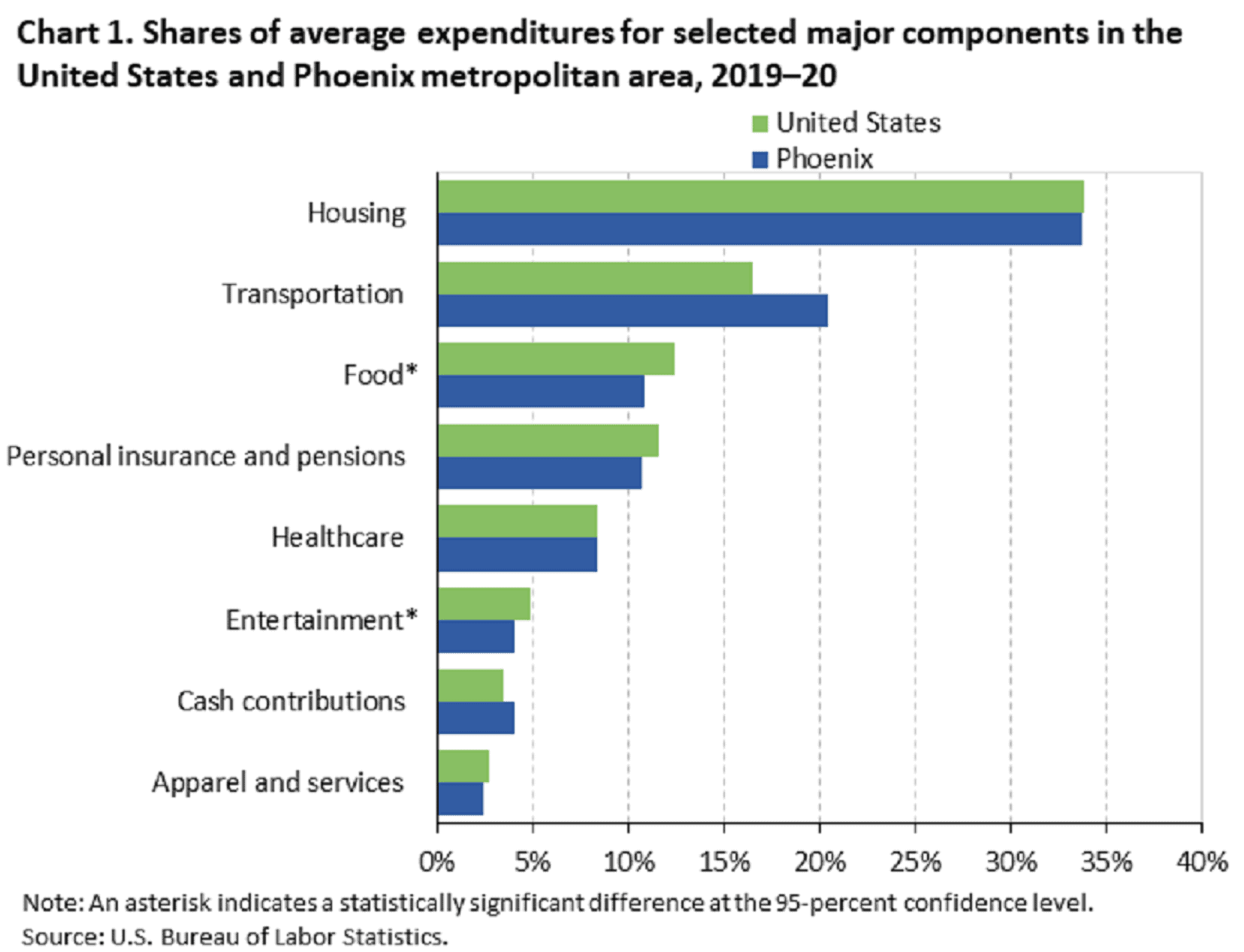

Mesa Az Cost Of Living 2022 Is Mesa Az Affordable Data Tips Info

Mesa Az Cost Of Living 2022 Is Mesa Az Affordable Data Tips Info

Tax Preparation Blau Company Accounting Tax Preparation Tempe Gilbert

Az Big Media How Capital Gains Taxes Affect Home Sales And How To Avoid Them Az Big Media